Independence Property Management Company

Independence, MO, offers investors superior cash flow through affordable housing and strong rental demand. However, maximizing returns requires navigating the city’s strict "Rental Ready" inspections. Partnering with a specialized Independence property management team ensures your asset remains compliant and profitable, turning high demand into consistent passive income.

Why Independence Is a Strong Market for Rental Property Owners

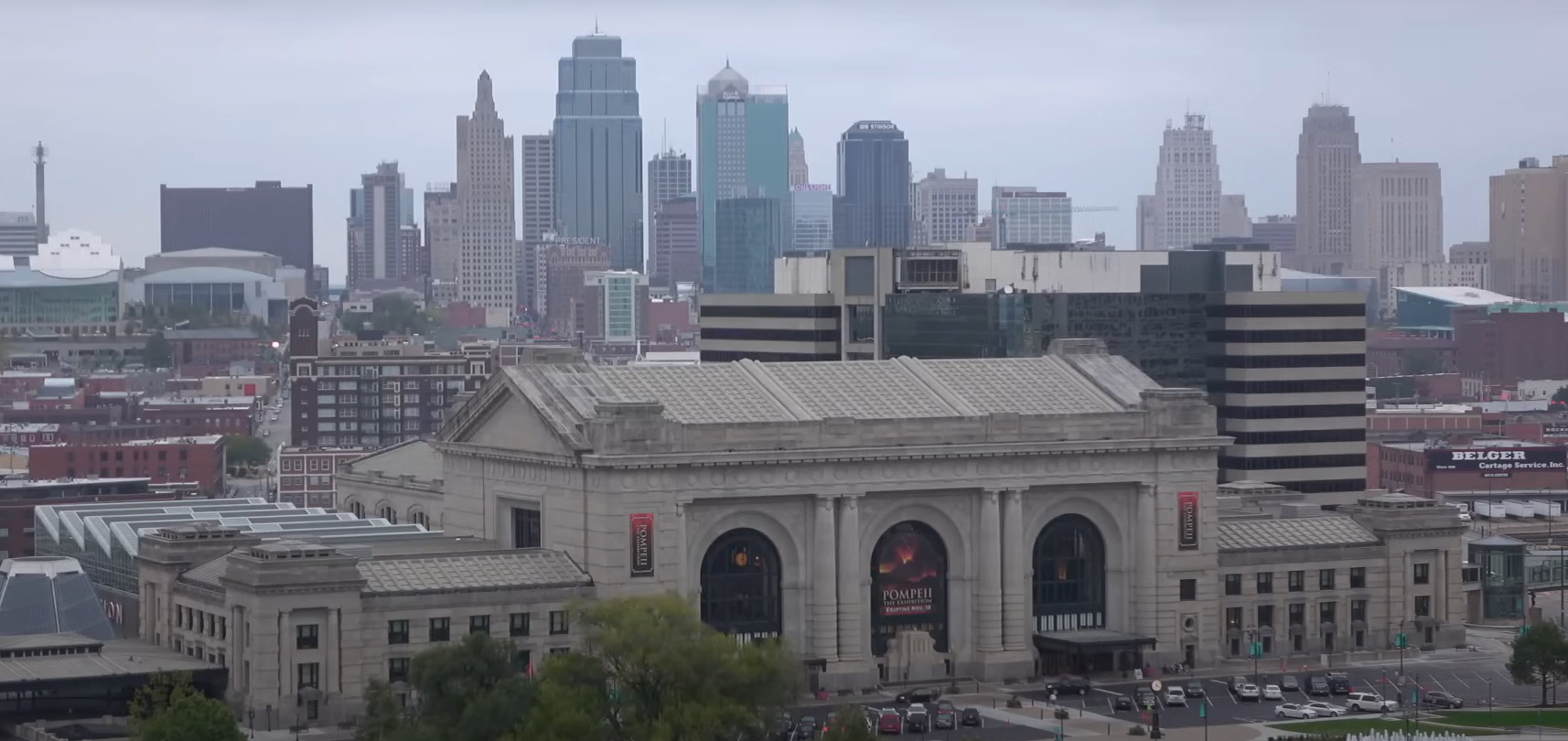

For real estate investors, Independence, Missouri, represents one of the most compelling “sweet spots” in the entire Kansas City metro. It offers a rare combination of affordable entry prices, high renter demand, and a diverse economy that insulates it from the volatility seen in other markets. As the fourth-largest city in Missouri and a historic hub with modern growth, Independence is no longer just a “bedroom community”—it is a primary target for investors seeking consistent cash flow and long-term stability. Partnering with an experienced Independence property management company allows owners to fully leverage these market advantages and operate rentals with greater efficiency and profitability.

Overview of Renter Demand in Independence

Demand for rental housing in Independence is robust and growing. With a median home price of approximately $220,000 (as of late 2025) and a steady influx of residents priced out of more expensive markets like Lee's Summit or Overland Park, the rental pool is deep. Renter-occupied households make up a significant portion of the population, driven by a workforce connected to local manufacturing, healthcare, and the growing logistics sector along the I-70 corridor. Vacancy rates in well-managed properties remain historically low, as families and professionals seek affordable, high-quality single-family homes and duplexes.

Neighborhood Insights: Where to Invest

Success in Independence comes down to knowing the distinct "micro-markets" that define the city.

- Englewood Arts District: Once a quiet commercial strip, this area has revitalized into a cultural hub. It attracts a younger demographic of renters who value walkability, art galleries, and local coffee shops. Properties here often command higher rents due to the "lifestyle" factor.

- Bundschu & Susquehanna: These neighborhoods in the northern and western parts of the city offer classic, stable suburban living. They are characterized by post-war bungalows and ranches that are popular with long-term family tenants. The rental demand here is driven by the desire for stability and good schools.

- Fairmount: Located near the western edge, closer to Kansas City proper, Fairmount offers some of the most affordable entry points for investors. While it may require more intensive management or rehab, the cash-on-cash return potential here is among the highest in the city.

Why Investors Choose Independence for Cash-Flow Potential

The math in Independence simply works better than in many other areas. While a rental in a high-cost coastal city might yield a 2-3% cap rate, Independence properties frequently deliver significantly higher returns. The rent-to-price ratio is favorable; investors can often purchase a turnkey or light-rehab property for under $200,000 and rent it for $1,300-$1,600+ per month. This allows for immediate positive cash flow, rather than banking solely on speculative appreciation. Furthermore, the city's "landlord-friendly" environment and stable property tax rates (relative to national averages) help preserve those margins.

How Local Market Knowledge Impacts Property Management Strategy

Independence is not a monolith. Managing a historic home near the

Harry S. Truman Presidential Library requires a different approach than managing a modern duplex near

Centerpoint Medical Center. A generic, one-size-fits-all management strategy will fail here. Local knowledge is critical for accurately pricing rent (to avoid vacancy while maximizing income), navigating specific

City of Independence code enforcement regulations, and understanding the unique maintenance needs of the area's diverse housing stock. This is where a specialized Independence property management partner becomes an asset, not just an expense.

Contact Us

What a Professional Independence Property Management Company Should Handle

Managing rental property in Independence requires more than just collecting checks; it demands navigating a specific set of local ordinances, including the city's rigorous "Rental Ready" program. A professional management partner acts as your operational shield, handling the complex logistics that can trip up self-managing owners.

Tenant Placement and Screening

Finding the right tenant is the first line of defense against income loss. In Independence, where renter demand is high for affordable single-family homes, the challenge isn't just finding a tenant—it’s finding the right one.

- Local Applicant Trends: With average rents for three-bedroom homes hovering around $1,384, Independence attracts long-term family tenants. A professional manager knows how to market specifically to this demographic, highlighting school districts and community amenities to attract stable residents.

- Screening Standards: Beyond standard credit and criminal checks, we screen for tenancy history that aligns with Independence's Rental Ready expectations. Since tenants play a role in maintaining the property to pass city inspections, placing a responsible resident is critical to avoiding fines.

Lease Enforcement and Rent Collection

Consistent cash flow relies on strict, legal enforcement of the lease. Missouri law allows landlords to make an immediate written demand for rent if payment is late, but navigating the eviction process in Jackson County requires precision.

- Local Regulations: Independence has specific ordinances targeting "deficient landlords." If a property accumulates too many code violations or complaints, the city can mandate monthly inspections for a six-month period. A professional manager enforces lease terms regarding property upkeep to prevent your asset from falling into this high-scrutiny category.

- Best Practices: We utilize online portals for rent collection, ensuring a documented paper trail for every payment—crucial evidence if a legal dispute ever arises.

Property Maintenance and 24/7 Repair Response

Independence has a diverse housing stock, from historic bungalows in the Englewood Arts District to mid-century ranches in Susquehanna. Each comes with unique maintenance needs.

- Common Repair Issues: Older homes in Independence often require specialized attention to electrical systems and window safety to comply with the city’s Rental Ready inspection checklist, which mandates window fall protection for certain units.

- 24/7 Response: Emergencies don't wait for business hours. Whether it’s a furnace failure during a winter freeze or a burst pipe, our 24/7 response team ensures that small issues don’t become "uninhabitable" conditions that violate city codes or drive tenants away.

Independence Section 8 Property Management

Independence has a robust market for Housing Choice Vouchers (Section 8), administered by the Independence Housing Authority (IHA). For investors, this is a reliable revenue stream, but it comes with strict bureaucracy.

- Navigating Inspections: To receive payments, units must pass the IHA’s Housing Quality Standards (HQS) inspection. This includes specific requirements like maintaining an interior temperature of at least 65°F between October and May and ensuring all windows have weather-tight seals.

- Why Specialized Experience Matters: A failed inspection freezes your rent payments. We pre-inspect properties to catch common failure points—like unsealed floors or lack of window screens—before the inspector arrives, ensuring your cash flow isn't delayed by a technicality.

The Real Costs of Self-Managing Rentals in Independence

Many investors start by self-managing to save on fees, but in a regulated market like Independence, "free" management often comes with a high price tag. The hidden costs of DIY management—ranging from extended vacancies to legal pitfalls—can quickly exceed the cost of hiring a professional.

Turnover, Vacancy, and Failed Inspections

In Independence, a vacancy isn't just about lost rent; it’s a compliance trigger. Under the city's Rental Ready program, a change in tenancy often requires a new inspection before a unit can be re-occupied. Self-managing owners often struggle to coordinate repairs and inspections quickly, leading to weeks of unnecessary downtime. Furthermore, failing an inspection due to a minor oversight (like a missing handrail or window lock) freezes your ability to lease the property, turning a simple turnover into a prolonged income loss.

DIY Maintenance Delays

Trying to handle maintenance yourself or relying on "budget" handymen is a risky strategy. In Independence, tenants have clear avenues to report unresolved issues to the city. If a landlord is deemed "deficient" due to unresolved code violations, the city can mandate a six-month period of monthly inspections at the owner's expense. A professional manager avoids this by using a vetted network of vendors to resolve issues before they escalate into city complaints.

Legal and Liability Risks

Navigating Jackson County's legal system requires precision. Whether it's drafting a lease that holds up in court or handling a security deposit refund according to Missouri strict statutes, one mistake can lead to costly lawsuits. Self-managing owners frequently find themselves liable for damages simply because they didn't document a move-in condition properly or followed an incorrect eviction procedure.

How These Issues Reduce ROI

Ultimately, every day a property sits vacant, every failed inspection re-fee, and every legal dispute chips away at your returns. While self-management saves a monthly management fee, it often costs investors thousands in lost revenue and asset value over the long run. Professional management protects your ROI by ensuring your property stays occupied, compliant, and profitable.

How to Choose the Right Independence Property Management Company

Not all property managers are created equal. In a market like Independence, where success relies on navigating hyper-local codes like the Rental Ready program and understanding neighborhood-specific tenant demand, choosing the wrong partner can cost you thousands in fines and vacancy. When vetting potential management companies, look for these specific qualifications and service capabilities.

What Qualifications and Experience Matter

In Missouri, a professional property manager must typically hold a real estate broker’s license to legally lease and manage properties for others. Verify that your manager is fully licensed and insured. Beyond the license, look for certifications like Certified Property Manager® (CPM®), which indicates a deeper level of training in asset analysis and operations. Crucially, ask about their specific experience in Independence. A manager who only knows downtown Kansas City or Overland Park may be blindsided by Independence’s specific inspection cycles and tenant demographics.

Local Service Capabilities to Look For

A "national" company with a 1-800 number cannot effectively manage a physical asset in Independence. You need a local team with boots on the ground. Look for these specific capabilities:

- In-House Maintenance or a Preferred Vendor Network: Do they have a list of vetted local contractors who can fix a furnace at 2 AM, or will your tenant be left in the cold?

- Rental Ready Compliance Expertise: Can they explain the City of Independence’s Rental Ready inspection checklist? If they don’t know what this is, they are not qualified to manage your property here.

- Tenant Screening Rigor: Do they perform multi-state background checks and verify income at 3x the monthly rent? This is the industry standard for securing stable, long-term residents.

Red Flags to Avoid

Be wary of companies that:

- Charge Vacancy Fees: You should not pay a management fee when your property is empty. This creates a disincentive for them to find a tenant quickly.

- Have Poor Communication: If they are slow to respond to you during the sales process, imagine how slow they will be when your tenant has an emergency.

- Lack Transparency in Accounting: You should have 24/7 access to an online portal where you can see every income and expense item. If you have to chase them for a monthly statement, it’s time to switch.

Why a Company with Independence-Specific Knowledge Ranks Higher in Performance

Real estate is hyper-local. A manager who understands that a rental in Englewood attracts a different tenant profile than one in Susquehanna can price your property accurately to minimize vacancy. They know that Fairmount offers high cash-flow potential but requires strict maintenance oversight. This specific knowledge translates directly to your bottom line: higher rents, lower turnover, and fewer costly compliance surprises.

Why Investors Trust Raven Property Management

For over 35 years, Raven Property Management has been a trusted partner for investors across the Kansas City metro, including the historic and growing market of Independence. We don’t just manage properties; we build wealth-generating portfolios. Our approach is built on a foundation of transparency, efficiency, and deep local expertise that turns your real estate investment into a true passive income asset.

Local Expertise Tailored to Independence

We understand that managing a rental in the Englewood Arts District requires a different touch than one in Susquehanna. Our team knows the neighborhoods, the rent benchmarks, and the specific City of Independence compliance nuances that maximize your property's performance. You get a partner who navigates the local landscape so you don't have to.

Proven Systems for Leasing, Maintenance, and Inspections

Our success is built on rigorous systems. From our data-driven tenant screening process that verifies income at 3x the market rent to our proactive, 24/7 maintenance response that prevents small repairs from becoming disasters, every aspect of your property's management is handled with professional precision. We also handle the complexities of Section 8 compliance and city inspections, ensuring your cash flow is never interrupted by a paperwork error.

Transparent Fees and Communication

We believe you should never have to guess where your money is going. We provide detailed financial reporting tools that give you a real-time snapshot of your property’s finances. Our fee structure is competitive and transparent, with no long-term commitments that lock you in. We earn your business every month by performing, not by trapping you in a contract.

Commitment to Maximizing Owner Cash Flow

Ultimately, our goal is aligned with yours: to maximize your return on investment. Whether it’s through strategic renovations to boost rent value, minimizing vacancy through aggressive marketing, or reducing turnover with excellent tenant relations, every decision we make is designed to protect your bottom line. We offer a true one-stop shop for your real estate journey, helping you buy, renovate, manage, and eventually sell your Independence properties with ease.

Ready to see how your Independence rental can perform at its peak? Contact Raven Property Management today for a free, no-obligation rental analysis.

Ready to work with Raven Property Management?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at 816-281-9357

Agency Contact Form

More Marketing Tips, Tricks & Tools