The Hidden Side of Owning Rental Property (And Why Most Owners Burn Out)

The Myth vs. Reality of Being a Landlord

The Easy Picture from the Outside

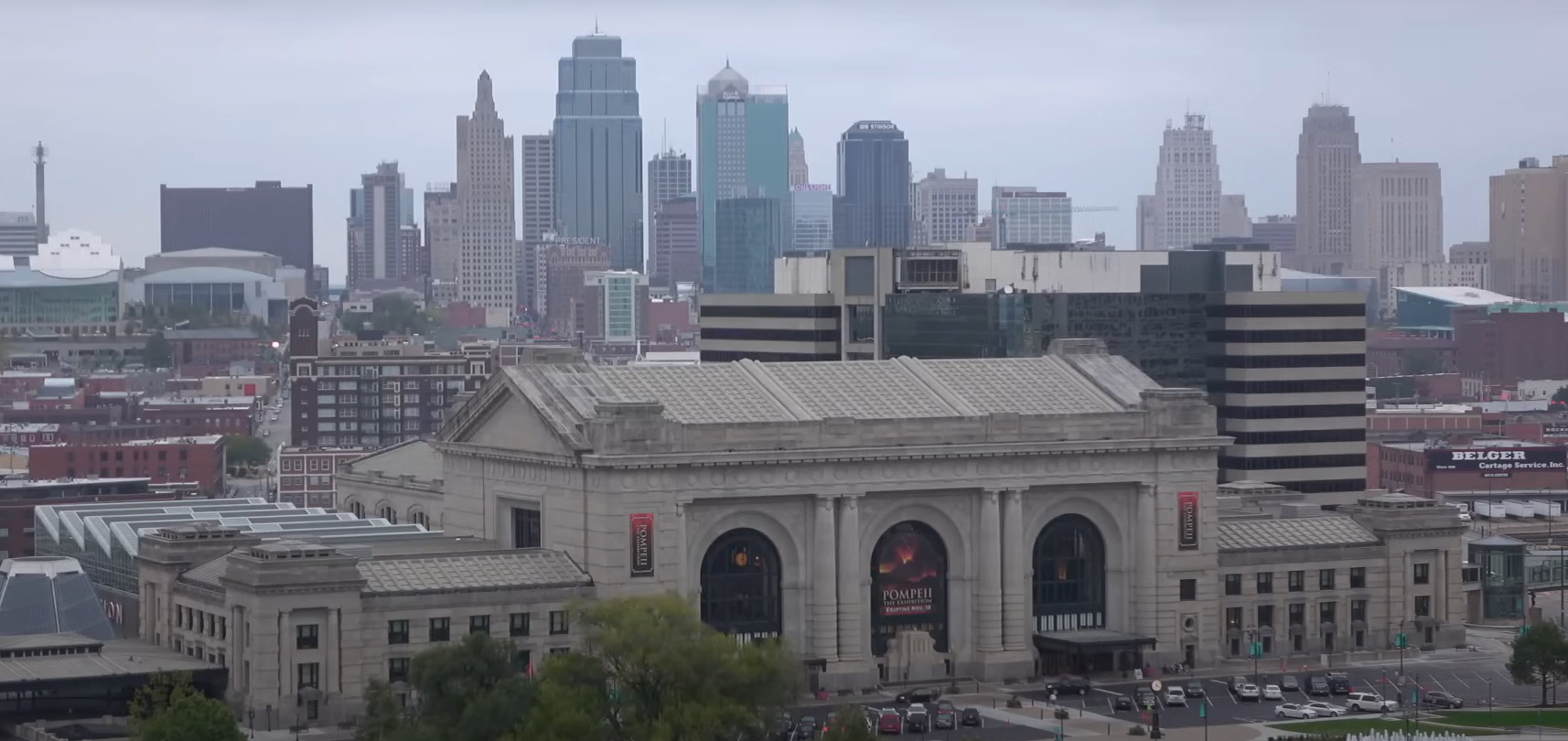

From the outside, owning rental properties as a business looks like a clear path to passive income. And the market supports this optimism: Kansas City remains an attractive market for investors, offering lower housing and rental costs than the national average and steady rent growth. In fact, the KC market has consistently ranked among the top ten largest U.S. markets for annual rent growth, recording a 3.3% increase in Q3 2024. This strong, stable demand is fueled by a diverse local economy in sectors like logistics, tech, healthcare, and finance.

The promise is real: steady appreciation (historically in the 6–8% annual range) and strong affordability make it a fantastic city to invest in. However, this promise is often based purely on market data, ignoring the immense time and effort required to secure that return.

What Really Happens Behind the Scenes

The reality is that managing a rental property is rarely passive—it’s a demanding second job. Behind the scenes, the easy picture dissolves into a constant stream of work, from setting up an LLC and business plan to complex screening and maintenance.

If you manage your own properties, you could easily spend 5–10 hours per week on the business, even on a single property. This time is spent on:

- Thorough Tenant Screening: This requires checking credit reports, background checks, collecting years of residence and employment history, and reviewing tenancy history to make sure you're renting to a suitable tenant.

- Maintenance: DIY landlords often handle quick fixes like a running toilet themselves, which saves money but costs time. Ignoring maintenance leads to larger, more expensive problems down the line.

- Legal Compliance: Landlords must be familiar with Missouri's landlord-tenant laws and local city requirements, such as the Kansas City Healthy Homes Rental Inspection Program registration and rules.

- Paperwork: You have to prepare the lease, handle rent collection, enforce rent policies, and conduct regular property inspections.

Owners quickly learn that maximizing an investment requires streamlined efficiency and a professional,

24/7 maintenance staff, not just a good property. Without professional help, the investment shifts from passive income to an overwhelming, full-time commitment.

Contact Us

The Biggest Risks Rental Owners Overlook

Vacancy as the Silent Killer

The most overlooked risk is the one that costs you money every single day: vacancy. An empty unit means $0 in rent, but 100% of the expenses—mortgage, insurance, and taxes—continue. For an owner of a single property in the Kansas City metro, where the average rent is about $1,290, one month of vacancy is a direct loss of cash flow that can wipe out months of profit.

While the Kansas City market is currently strong—with occupancy rates at around 93.5% as of Q3 2024 and demand beginning to outpace new supply—vacancy rates can fluctuate depending on the submarket, with some suburban areas like Johnson County seeing occupancy in the 95.1% range. A professional manager's expertise in marketing, pricing, and rapid tenant turnover is crucial to mitigating this risk. Raven Property Management focuses on high rates of long-term tenant retention to keep your cash flow consistent.

The Cost of a Bad Tenant

A bad tenant is far more expensive than a short vacancy. The costs stack up quickly, often far exceeding the security deposit:

- Lost Income: An eviction process in Missouri typically takes 1 to 3 months from start to finish, potentially stretching to 4-6 months if the tenant contests it. This means you lose 1 to 3 months' rent during the process.

- Property Damage & Turnover: Bad tenants can cause damage beyond normal wear and tear, costing between $200 and $5,000+ in repairs, followed by additional turnover costs to make the unit rentable again.

- Legal Fees: Eviction costs often include court filing fees (around $62 in Jackson County) and private legal fees, which can range from $500 to over $10,000 for a contested case.

This risk is why a rigorous tenant screening process—which includes checking rental history, income verification, and comprehensive background checks—is the single most important action a property manager performs. It is the first line of defense against financial catastrophe.

Maintenance That Can’t Wait

Maintenance issues don't follow a 9-to-5 schedule. A broken furnace during a Missouri deep-freeze or a burst pipe at 2 a.m. requires immediate attention. These emergencies demand prompt response from a reliable, licensed vendor to prevent minor issues from becoming catastrophic, uninsurable damage. For an overwhelmed owner, this constant pressure is a major source of burnout. For Raven, it’s just business, handled by our 24/7 maintenance staff and trusted network of licensed, insured, and background-checked home service vendors.

Why Property Management Is Really About People

More Than Just Real Estate

With over 35 years of experience in the industry, Raven Property Management knows that success in Kansas City isn't about buildings; it's about people and relationships. The Kansas City renter demographic is dynamic: while the general population is growing due to high in-migration, the 65–74 age group is the fastest-expanding renter demographic in the metro area. This shift suggests increasing demand for stable housing that caters to an aging population.

Managing this requires more than just collecting rent; it demands empathy, conflict resolution skills, and a deep, specialized understanding of fair housing laws. We specialize in handling conventional, senior, VA, and HUD low-income (Section 8) rentals, ensuring every homeowner’s portfolio is managed with compliance and care. The Housing Authority of Kansas City (HAKC) even highlights the benefit of guaranteed monthly assistance payments for landlords who comply with their requirements.

Juggling Tenants, Contractors, and Compliance

Property management requires constant, delicate juggling. You are the mediator between tenants and their needs, contractors and their schedules, and a labyrinth of local and federal laws.

Compliance is paramount, and the Kansas City, MO, Code of Ordinances prohibits discrimination based on protected classes beyond the federal standard, including sexual orientation and gender identity. Additionally, all Kansas City, MO, rental property owners are required to register their properties through the Healthy Homes Rental Inspection Program.

For landlords in the Housing Choice Voucher (HCV) / Section 8 program, the complexity multiplies:

- Owners must pass the initial and annual Housing Quality Standards (HQS) inspection.

- The rent must be deemed "reasonable" compared to other units in the area by the Housing Authority.

- The owner must sign a Housing Assistance Payment (HAP) Contract with the local Housing Authority.

When an issue arises, you need a responsive, proven network of vendors—a trusted network of licensed, insured, and background-checked home service vendors—who can be dispatched immediately. This logistical and interpersonal complexity is what burns out most individual owners. We handle this burden, providing peace of mind to investors who own one unit or a thousand.

How Professional Property Management Changes the Game

Systems That Prevent Problems Before They Start

The difference between an overwhelmed owner and a successful investor is a professional system. Raven Property Management provides this comprehensive, efficient structure. We offer a one-stop shop for all your real estate needs. This full-service model, which includes rental, sales, investment, renovation, and mortgage partnership, eliminates the requirement for homeowners to manage various building professionals and parties, ensuring continuity and maximizing your returns. This is the ideal strategy for investors looking to buy, sell, or simply lease properties in the Kansas City metro.

Rigorous Tenant Screening and Proactive Maintenance

The single most effective way to change the game is through superior tenant selection. We don't just check the boxes; our expert leasing and maintenance teams perform a rigorous, data-driven screening process to secure responsible, high-quality tenants. This thorough assessment includes:

- Income Verification: Requiring gross income to be at least three times the market rent and verifying it with paystubs and employment references.

- Rental History: Confirming a minimum of two years of verifiable history with previous landlords, specifically asking if the landlord would rent to them again.

- Background Checks: Conducting detailed credit reports, eviction history checks, and criminal background checks.

This commitment to quality dramatically reduces turnover and property damage risks. Furthermore, our approach to maintenance is proactive, not reactive. Preventative maintenance is an investment that preserves and enhances a property's value. We leverage our 24/7 maintenance staff and established trusted network of home service vendors to conduct routine, scheduled maintenance on critical systems like HVAC and plumbing to avoid costly emergency repairs and maintain regulatory compliance.

Clear Communication and 24/7 Support

For owners who live out of state or simply want to reclaim their time, the value of having an expert point of contact is immeasurable. Raven Property Management provides clear, consistent communication and 24/7 expert support. This includes:

- Prompt, efficient response to tenant requests to ensure satisfaction and retention.

- Detailed financial reporting tools that provide real-time accounting and accurate snapshots of your property's finances at all times.

- Transparency and communication so you always understand what we're doing and how your property is performing.

Our focus on transparent systems and consistent tenant satisfaction is what drives high rates of long-term tenant retention.

The Payoff for Owners and Tenants

Preserving Sanity and Protecting Investments

The primary payoff is preserving your sanity. By offloading the stress of day-to-day management to Raven Property Management KC, you protect your personal time while actively protecting your investment. With our 35 years of experience and competitive pricing with no long-term commitment, we make property management seamless—whether you own one unit or a thousand. For investors looking to expand, we are a true one-stop shop that provides renovation, fix & flips, and agency agreements for investors looking to acquire new properties, ensuring stable, predictable income and portfolio growth.

Happier Tenants, Longer Stays

The ultimate metric of success in property management is tenant retention, as frequent turnover harms the long-term value of your investment and disrupts cash flow. Replacing a tenant can cost up to five times the monthly rent. By contrast, encouraging renewals leads to substantial savings by reducing marketing costs (which can range from $50 to several hundred dollars) and eliminating the revenue gap from vacancy loss (which averages 30 to 45 days).

Our approach directly counters these costs by focusing on high rates of long-term tenant retention:

- Responsive Maintenance: Quick and efficient handling of repair requests is a dealbreaker for tenants and fosters the trust that encourages lease renewal.

- Strong Relationships: Tenants who feel valued and respected are more likely to stay.

- Competitive Pricing: We perform local market analysis to set competitive rent prices, encouraging tenants to renew.

Happier tenants are also more likely to treat the property as their own home, leading to reduced wear and tear and less costly maintenance.

Growing Property Value the Right Way

A rental property should be a wealth-building asset, and our approach ensures it is. Our proactive maintenance strategy goes beyond simple repairs—it is a critical investment that preserves and enhances the property's value over time.

- Long-Term Value: Homes receiving regular maintenance typically sell for 10%–15% more than neglected properties.

- Preventative Care: Seasonal maintenance, like HVAC servicing and gutter cleaning, prevents small issues from escalating into major, costly repairs that can harm structural integrity.

- Curb Appeal: Well-maintained landscaping and a clean exterior positively impact curb appeal, which is essential for market standing and attracting quality tenants.

- Smart Upgrades: Investing in quality renovations, like modernizing kitchens or replacing carpet with hard surface flooring, is a key way to increase rental value and long-term profitability in Kansas City.

This commitment to quality, backed by a trusted network of licensed, insured, and background-checked vendors, maximizes your asset’s value and ensures it remains competitive in the Kansas City market.

Final Takeaway

It’s Not Just About Buildings—It’s About Homes

The journey of property ownership in the Kansas City metro often begins with the dream of passive income, but the reality can quickly become overwhelming, filled with compliance hurdles, costly vacancies, and late-night maintenance calls. This is the hidden side of being a landlord, and it’s why so many owners burn out.

At Raven Property Management KC, we believe that your investment should build wealth, not stress. Our mission is to take on the daily grind and regulatory burden so you can focus on the rewards.

We offer seamless management, backed by:

- 35 Years of Expertise: Ensuring your property is handled with streamlined efficiency.

- The One-Stop Shop Advantage: Covering everything from expert leasing for HUD low-income, Section 8, VA, and senior rentals to sales, renovation, and investment property acquisition.

- Protection Through People: Utilizing a rigorous, data-driven tenant screening process and a trusted network of licensed, insured, and background-checked vendors to minimize risks.

- 24/7 Peace of Mind: Providing continuous expert support and proactive maintenance to reduce emergencies and drive high rates of long-term tenant retention.

It’s time to stop worrying about toilets and leases, and start enjoying the stability and appreciation of your Kansas City asset. Protect what matters most—your investment, your time, and your peace of mind.

Contact Raven Property Management KC today to maximize your investment with no long-term commitment.

Ready to work with Raven Property Management?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at 816-281-9357

Agency Contact Form

More Marketing Tips, Tricks & Tools