Real Estate Investing Kansas City: How to Find High-Cash-Flow Single-Family Rentals

Real passive income isn't a fantasy—it's a proven reality for investors in Kansas City. But the difference between a headache and a high-yield asset often comes down to a few critical decisions. Skip the learning curve and tap into our deep well of local real estate wisdom to unlock the blueprint for finding, buying, and profiting from single-family rentals in one of the nation's most robust economies.

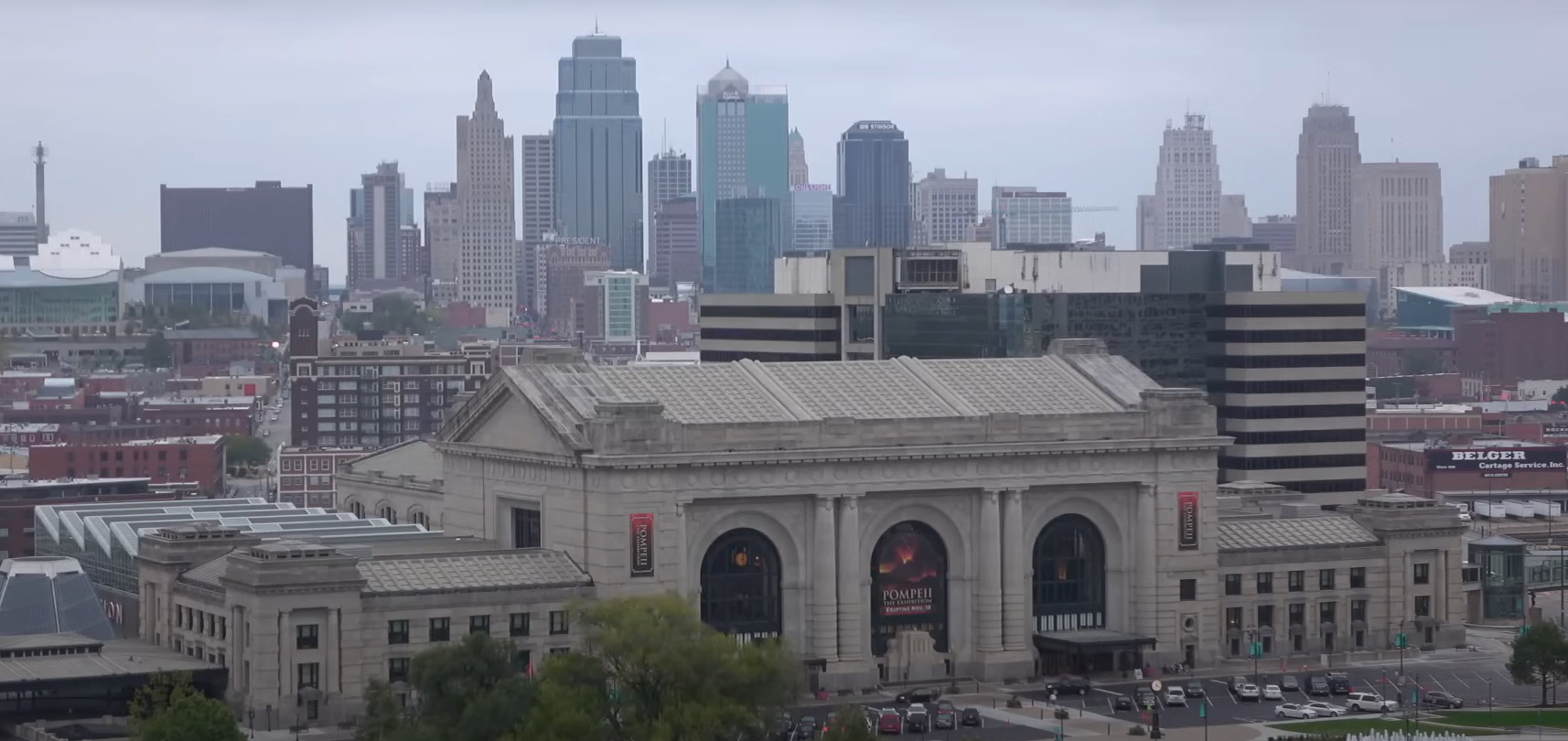

Why Kansas City Is a Top Market for Cash-Flow Rentals

For real estate investors, the days of relying solely on coastal markets for appreciation are fading. The “Silicon Prairie” is no longer a secret, and Kansas City has emerged as a primary target for investors seeking a balance of affordability, stability, and genuine cash flow. As a local partner specializing in Kansas City multifamily property management, Raven Property Management has seen firsthand how out-of-state capital is shifting to the Midwest to capitalize on these unique market conditions.

Population growth and steady rental demand

Kansas City isn’t just growing; it’s growing sustainably. The Kansas City metro area population is projected to reach 2,400,000 in 2025, maintaining a steady annual growth rate of approximately 0.86%. This steady influx isn’t a boom-and-bust cycle but a consistent upward trend driven by the region’s affordability and quality of life. That population growth directly fuels rental demand. While national rental vacancy rates hover around 6.6–7.0%, Kansas City’s multifamily market has demonstrated resilience, with vacancy rates stabilizing near 5–6% in key submarkets—indicating strong demand for quality rental housing. With occupancy rates consistently high, investors can rely on a stable tenant pool, particularly for single-family homes and multifamily communities that remain in short supply relative to demand.

Affordability compared to coastal markets

The "entry price" gap between Kansas City and coastal metros is staggering. As of early 2025, the median home sold price in Kansas City sits around $233,000 - $275,000, with some reports showing a median listing price near $310,000. Compare this to median prices in San Jose ($1.45M+), San Francisco ($1.25M+), or Los Angeles ($1M+), and the math becomes undeniable. An investor can acquire a portfolio of 4 to 5 cash-flowing properties in Kansas City for the cost of a single, potentially negative-cash-flow asset in a coastal city. This lower barrier to entry allows for greater diversification and higher potential returns on initial capital.

Job expansion and economic stability

Kansas City’s economy is built on a diverse foundation that insulates it from single-sector volatility. The region is a national logistics powerhouse, located within a two-day truck drive of 85% of the U.S. population, which guarantees a permanent base of blue-collar rental demand. Beyond logistics, the "Silicon Prairie" effect is real: the tech industry now drives a significant portion of the local economy, with tech job postings increasing by over 10% recently. Major employers in healthcare, finance, and engineering continue to expand, with total nonfarm employment reaching over 1.15 million in 2024. This economic diversity means your tenants aren't dependent on one fragile industry—they are spread across resilient sectors like healthcare, tech, and trade.

Why KC attracts out-of-state investors

Out-of-state investors are flocking to Kansas City because it offers what their local markets cannot: predictability. In high-cost markets, investors are often speculating on appreciation while eating monthly losses. In Kansas City, the "price-to-rent" ratios actually make sense. With median rents for single-family homes ranging from $1,300 to over $1,800 depending on size and location, investors can achieve the "1% rule" (monthly rent is 1% of purchase price) far more easily than in coastal hubs. Combined with landlord-friendly laws in Missouri and a stable legal environment, Kansas City provides a "safe harbor" for capital that seeks steady, passive growth without the wild volatility of boom-town markets.

Why Kansas City is a TOP Housing Market in 2025 This video provides a local expert's breakdown of why Kansas City's market fundamentals—job growth, affordability, and infrastructure—are driving its status as a top housing market in 2025.

Contact Us

Best Kansas City Neighborhoods for Cash Flow

For investors prioritizing monthly income over speculative appreciation, the "boring" neighborhoods often perform best. While areas like the Country Club Plaza or Brookside offer prestige, their high entry costs destroy cash flow margins. The real opportunities for 8–12% returns are found in the working-class suburbs and revitalizing corridors where demand for single-family rentals is insatiable.

Key areas with strong rental demand

- Grandview (South KC): Located directly along the I-49 corridor, Grandview is a logistics and manufacturing hub. This area has a perpetual demand for workforce housing, with 3-bedroom homes renting quickly to long-term tenants.

- Independence (East Jackson County): As the hometown of Harry S. Truman, Independence offers historic charm at a discount. It is a "bread and butter" rental market where entry prices remain low (often under $185k), but rents remain strong due to its size and proximity to KC.

- Raytown: Sitting just southeast of the city, Raytown is a quiet, blue-collar community. It is a favorite for cash-flow investors because property taxes are relatively reasonable, and the tenant base is stable, often staying in properties for 3+ years.

Neighborhoods with the best rent-to-value ratios

If your goal is the "1% Rule," look north and east.

- Ruskin Heights & Hickman Mills (South KC): These neighborhoods are legendary among cash-flow investors. You can often find smaller 3-bedroom post-war bungalows for $120,000–$150,000 that rent for $1,300+, exceeding the 1% rule.

- Historic Northeast: Areas like Pendleton Heights and Indian Mound offer stunning historic architecture at a fraction of the cost of other historic districts. While rehab costs can be higher here, the rent-to-purchase spread is massive for those willing to manage older buildings.

Areas with long-term appreciation potential

For investors willing to sacrifice a little immediate cash flow for massive future equity, look where the city is growing.

- North Kansas City & Gladstone (The Northland): The Northland is booming. With excellent schools (like North Kansas City Schools) and rapid commercial development, homes here appreciate faster than the metro average. You buy here for stability and wealth building.

- Lee's Summit & Blue Springs: These A-class suburbs offer the perfect blend. While entry prices are higher ($300k+), the appreciation rate is steady, and the tenant quality is exceptional, often attracting six-figure earners who treat the rental like their own home.

Zip codes with strong 2–3 bedroom single-family rental performance

When scanning Zillow or the MLS, keep an eye on these high-performing zip codes:

- 64030 (Grandview): High volume of 3-bed/1-bath ranches; ideal for Section 8 and workforce housing.

- 64134 (Ruskin/Hickman): One of the highest cash-on-cash return areas in the entire metro.

- 64050 & 64055 (Independence): A massive inventory of rental-grade single-family homes with low vacancy rates.

- 64118 (Northland/Gladstone): A "sleeper" zip code offering affordable mid-century homes with great highway access to downtown.

What to Look for in a High-Performing Rental Property

Identifying a profitable rental requires looking past the cosmetic appeal to the structural and financial bones of the property. In Kansas City, where housing stock ranges from turn-of-the-century historic homes to 1990s suburban builds, understanding what tenants actually want—and what will cost you the most to maintain—is critical.

Ideal Property Size, Layout, and Condition

For single-family rentals in Kansas City, the "sweet spot" is a 3-bedroom, 2-bathroom home with at least 1,200 square feet. This configuration appeals to the widest pool of stable, long-term tenants: families. Data shows that 3-bedroom homes in the metro rent for a median of $1,500–$1,700, significantly higher than 2-bedroom units which often compete directly with apartments. Look for layouts with open living areas and, crucially for the Midwest, a basement (finished or unfinished) for storage and storm safety. Avoid properties with "functional obsolescence," such as pass-through bedrooms or tiny kitchens, which lead to higher tenant turnover.

Age of Systems: The "Big Four"

Before making an offer, audit the "Big Four" expensive systems. In Kansas City's climate of freezing winters and hot, humid summers, these systems are tested annually.

- Roof: A 20-year asphalt shingle roof is standard. If it's nearing end-of-life, budget $8,000–$12,000 for replacement immediately.

- HVAC: A furnace and A/C unit older than 15 years is a ticking time bomb. Replacing a full system can cost $6,000–$10,000, so factor this into your offer price.

- Electrical: In older KC neighborhoods (like Waldo or Brookside), watch out for knob-and-tube wiring or ungrounded outlets, which are safety hazards and insurance nightmares.

- Plumbing: Cast iron stack pipes and galvanized supply lines in pre-1970 homes often fail and are costly to replace.

Estimating Rehab Costs and Value-Add Opportunities

Don't over-improve. The goal is a durable, clean, and modern rental, not a luxury flip.

- Smart Value-Adds: Focus on high-ROI updates like LVP (Luxury Vinyl Plank) flooring, which is waterproof and durable, fresh neutral paint, and modern light fixtures. These relatively low-cost updates can increase rent potential by $100–$200/month.

- Rehab Budgeting: For a standard cosmetic rehab (paint, flooring, minor fixtures) in Kansas City, budget approximately $15–$25 per square foot. For a property needing a new kitchen, bath, and systems, budget $40–$60 per square foot. Always add a 15% contingency fund for the "unknowns" that inevitably arise in older Midwest homes.

Vacancy Risk Indicators and Tenant Profile

The best hedge against vacancy is buying where tenants want to live. Avoid blocks with boarded-up windows or high commercial traffic. Instead, look for "pride of ownership" indicators: manicured lawns, newer cars in driveways, and proximity to good schools and highways. In the current market, properties with pet-friendly amenities (fenced yards) and modern conveniences like in-unit laundry hookups lease significantly faster and keep tenants longer.

Working With a Kansas City Property Management Partner

For out-of-state investors, the difference between a passive investment and a part-time job often comes down to their property management partner. While the numbers on a spreadsheet might look perfect, the operational reality of managing a property from hundreds of miles away—handling late-night maintenance calls, navigating local compliance, and managing tenant turnover—can quickly erode your returns.

How Property Managers Help Out-of-State Investors

A professional management team acts as your "boots on the ground," replacing the chaos of self-management with streamlined systems. For investors who live outside the Kansas City metro, having an expert point of contact is immeasurable. We handle the logistical burden—from ensuring compliance with the Kansas City Healthy Homes Rental Inspection Program to managing vendor schedules—so you don't have to. This support transforms a demanding asset into a truly passive investment, allowing you to focus on portfolio growth rather than daily operations.

What to Expect from Tenant Placement and Screening

The single most important action to protect your investment is rigorous, data-driven tenant screening. At Raven Property Management, we don't rely on gut feelings. Our expert leasing teams perform a comprehensive assessment that includes:

- Income Verification: We require an applicant's gross income to be at least three times the market rent, verified with paystubs and employment references.

- Rental History: We confirm a minimum of two years of verifiable history with previous landlords, specifically asking if they would rent to the applicant again.

- Comprehensive Background Checks: We conduct detailed credit reports, national eviction history checks, and criminal background checks to ensure a complete picture of every applicant.

Full-Service Management vs. Leasing-Only

Investors have different needs, and your management partner should offer flexibility. A full-service model handles everything from rent collection and 24/7 maintenance to financial reporting and legal compliance. This is ideal for out-of-state owners who want a "hands-off" experience. However, some investors may only need help finding a tenant. A leasing-only service focuses solely on marketing, showing, and screening tenants, handing the day-to-day management back to the owner once the lease is signed. At Raven, we are a true one-stop shop, offering not just management and leasing, but also renovation, investment acquisition, and sales services to support your entire investment lifecycle.

How Good Management Boosts Long-Term ROI

Professional management isn't an expense; it's an investment in your asset's longevity. The primary driver of ROI is tenant retention. Replacing a tenant can cost up to five times the monthly rent in turnover costs, marketing, and lost income. By setting competitive rent prices based on local market analysis and providing responsive, 24/7 maintenance support, we foster strong relationships that encourage tenants to stay longer. Furthermore, our proactive maintenance strategy preserves the property's condition, often allowing homes to sell for 10%–15% more than neglected properties when it’s time to exit the investment.

Final Checklist for Buying a Cash-Flow Single-Family Rental in Kansas City

The difference between a high-performing asset and a "money pit" often comes down to due diligence. Before you sign a contract, use this checklist to verify that your potential Kansas City investment is a sound business decision, not just a cheap house.

Financial Metrics to Verify

Never rely on "pro-forma" or estimated numbers provided by a seller. Run your own verification:

- Rent Roll: For existing rentals, request the last 12 months of actual rent collection logs, not just the lease agreement. A lease says what they should pay; the rent roll says what they did pay.

- Utility Bills: In older KC homes, drafty windows and poor insulation can lead to massive winter heating bills. Request the last 12 months of utility costs to ensure they don't eat into your tenant's ability to pay rent (if utilities are tenant-paid) or your own margins (if landlord-paid).

- Property Taxes: Missouri reassesses property taxes in odd-numbered years. Verify the current assessment and anticipate potential increases, especially if you are buying at a significantly higher price than the current tax appraisal.

Inspection and Rehab Considerations

A standard home inspection isn't enough for an investor. You need to look for the specific "deal-killers" common in this region:

- Foundation Check: Kansas City's clay soil expands and contracts, causing basement walls to bow or crack. A structural failure can cost $10,000–$20,000 to repair, instantly destroying your ROI. Always check for horizontal cracks or "stair-step" cracks in brick foundations.

- Sewer Scope: This is non-negotiable. Many older neighborhoods like Waldo, Brookside, and Independence still have clay sewer pipes that are prone to collapse or root intrusion. A $200 scope can save you from a $10,000 line replacement.

- Water Management: Check that grading slopes away from the foundation and that gutters/downspouts are functional. Poor drainage is the #1 cause of wet basements in KC rentals.

Long-Term Maintenance Planning

Don't just budget for today's repairs; budget for the asset's lifecycle.

- CapEx Reserves: Set aside a portion of monthly rent (typically 5-10%) specifically for Capital Expenditures (CapEx) like a future roof (every 20 years) or HVAC system (every 15-20 years).

- Winterization: Ensure the property is "winter-proof." This includes checking insulation levels in the attic, servicing the furnace annually, and disconnecting exterior hoses to prevent frozen pipes—a common and costly issue in Midwest winters.

When a Deal is Worth Pursuing or Walking Away From

- The "Green Light": The property meets the 1% rule (or comes close), has a solid foundation and sewer line, is located in a stable school district (like Raytown, Independence, or North KC), and requires only cosmetic updates (paint/flooring).

- The "Red Light" (Walk Away): The property has major structural bowing, active knob-and-tube wiring that requires a whole-house rewire, or is located on a block with more boarded-up homes than occupied ones. Additionally, if the seller refuses to allow a sewer scope or utility activation for inspection, walk away immediately.

Ready to work with Raven Property Management?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at 816-281-9357

Agency Contact Form

More Marketing Tips, Tricks & Tools