Tenant Placement & Screening in Grandview, MO

Effective tenant placement and screening in Grandview, MO, is the primary defense against income loss for rental property owners. With eviction processes in Missouri potentially taking months and bad placements often causing damages that far exceed security deposits, a rigorous screening process is essential for protecting your investment. Raven Property Management KC utilizes a data-driven approach, verifying that applicants have a gross income of at least three times the market rent and a minimum of two years of verifiable rental history. By conducting comprehensive background and credit checks, we secure responsible, long-term tenants who ensure consistent cash flow and asset preservation. Contact us today to secure your Grandview rental with professional placement services.

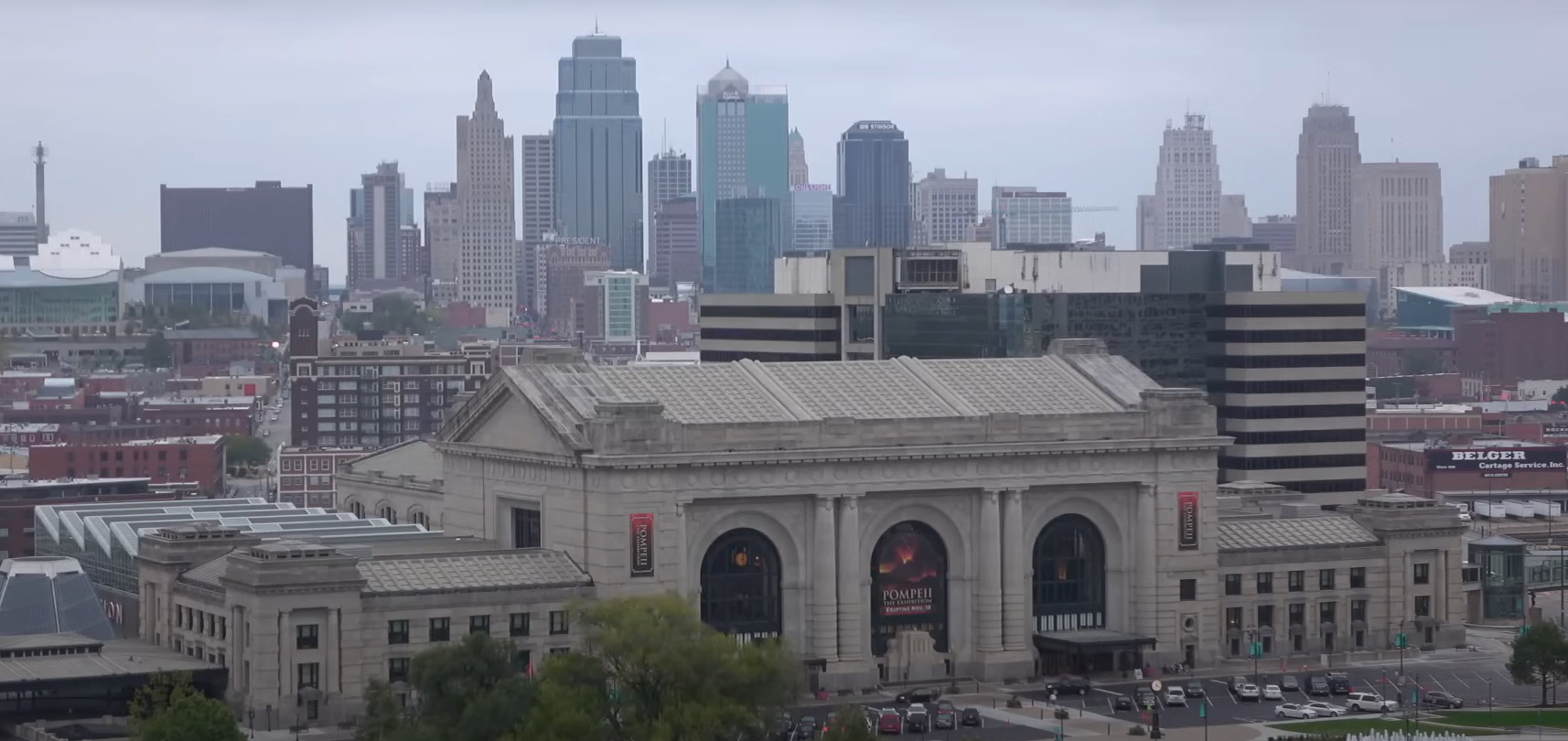

Owning a rental property in Grandview offers a compelling opportunity for investors, blending strong affordability with steady appreciation. Whether your investment is a single-family home near the historic Harry S. Truman Farm Home or a multi-unit property with convenient access to I-49, the long-term success of your investment hinges on one critical factor: who lives there.

While market fundamentals in Grandview are strong, placing the wrong tenant can quickly turn a profitable asset into a financial liability. That’s why

tenant screening in Grandview MO is one of the most important protections an owner can put in place. At

Raven Property Management KC, we rely on a rigorous, data-driven screening process to protect our clients’ investments. With over 35 years of experience across the Kansas City metro, we replace gut feelings with verified income, rental history, and screening standards—helping ensure your property is occupied by reliable residents who pay on time and respect the home.

Contact Us

Why Professional Tenant Screening Matters for Grandview Rental Properties

Many owners assume that finding a tenant is simply a matter of putting a "For Rent" sign in the yard and picking the first person with a deposit. However, in a dynamic rental market, professional screening is your primary defense against income loss and legal risk. It acts as a filter, separating high-quality applicants from those who may cause significant headaches down the road.

How poor tenant placement affects cash flow and property condition

A bad tenant is far more expensive than a month of vacancy. When a tenant stops paying rent or damages the property, the costs stack up immediately. In Missouri, the eviction process can take anywhere from one to three months, during which you receive zero income while still paying the mortgage, insurance, and taxes.

Beyond lost rent, the physical toll on your asset can be devastating. We have seen bad placements result in property damage exceeding $5,000—far more than a security deposit covers. When you factor in potential legal fees, which can range from $500 to over $10,000 for a contested eviction, the total cost of a single screening failure can wipe out years of profit.

Common screening mistakes self-managing owners make

Self-managing landlords often fall into the trap of emotional decision-making or rushing to fill a vacancy to stop the bleeding of lost rent. Common pitfalls include accepting screenshots of credit scores instead of running independent reports, failing to call previous landlords for references, or accepting cash income without proper verification.

Without access to professional-grade background checks, owners may miss critical red flags such as prior evictions or criminal history that doesn't show up in a basic search. Additionally, many DIY landlords unknowingly violate Fair Housing laws during the interview process, exposing themselves to significant legal liability.

Why consistent screening standards matter in Grandview rentals

Consistency is key to both profitability and legality. Professional property managers utilize a strict, objective set of criteria for every single applicant. This standardization ensures that no one is unfairly discriminated against, keeping you compliant with federal laws and local regulations.

By enforcing clear standards—such as requiring gross income to be at least three times the monthly rent and demanding two years of verifiable positive rental history—you eliminate the guesswork. This disciplined approach ensures that every tenant placed in your Grandview rental has the financial stability and track record necessary to be a successful, long-term resident.

Our Tenant Placement & Screening Process in Grandview MO

Finding the right tenant is a science, not a guessing game. At Raven Property Management, we have refined a multi-step screening process designed to filter out risk while quickly securing qualified residents for your home. We treat every application with the scrutiny of a loan underwriter, ensuring that the person we hand keys to is financially stable and responsible.

Marketing and positioning the property to attract qualified tenants

Great screening starts with great marketing. You cannot screen high-quality tenants if they never apply. We position your Grandview property to stand out in the local market by highlighting the specific amenities that families and professionals value, such as easy access to I-49, proximity to The View Community Center, or the charm of revitalized Main Street.

Our leasing team uses professional photography and compelling descriptions to syndicate your listing across top rental platforms. By accurately pricing the home based on current neighborhood data, we generate a pool of serious, well-qualified applicants rather than bargain hunters, setting the stage for a successful tenancy before a single application is even processed.

Application review, identity verification, and background checks

In an era of digital fraud, verifying who an applicant says they are is the first line of defense. We begin with strict identity verification to prevent subletting scams or identity theft. Once identity is established, we conduct comprehensive nationwide background checks. This goes beyond a simple local search; we look for criminal history and prior evictions that might indicate a pattern of behavior incompatible with a safe, quiet community.

Income, employment, and rental history verification

Financial stability is non-negotiable. To ensure a tenant can comfortably afford the home, we require verifiable gross monthly income of at least three times the market rent. We do not take an applicant's word for it; we verify employment directly with supervisors and audit paystubs to confirm steady income.

Equally important is how they have treated previous rentals. We require a minimum of two years of verifiable rental history. Our team contacts previous landlords directly—not just the current one, who might be motivated to get rid of a bad tenant, but prior ones who will give an honest assessment. We ask the hard questions: Did they pay on time? Did they damage the unit? Would you rent to them again?

Credit evaluation and risk assessment

A credit score is just a number; we look at the full financial story. Our credit evaluation analyzes the applicant's debt-to-income ratio and payment history to assess their financial responsibility. We differentiate between medical debt or student loans versus a history of missed utility payments or outstanding balances with previous property management companies, which are major red flags. This holistic view allows us to select tenants who prioritize their housing payments.

Lease approval and coordinated move-in

Once an applicant clears our rigorous screening, we move to secure the lease. We prepare a legally robust lease agreement compliant with all Missouri laws, clearly outlining tenant responsibilities regarding maintenance, rent payment, and property care. This comprehensive process is the cornerstone of our Grandview property management services, ensuring that from day one, the tenant understands the professional standards expected of them. We then coordinate a documented move-in inspection to establish the property's baseline condition, protecting your security deposit claim should any damage occur in the future.

Tenant Screening as a Foundation of Long-Term Investment Performance

A rigorous screening process is the bedrock of a high-performing rental portfolio. While location and property condition matter, the tenant ultimately determines whether an investment delivers consistent returns or becomes a financial drain. This is why grandview property management fees should be viewed not as a cost, but as a long-term risk management investment that protects cash flow and asset value.

Balancing fast leasing with tenant quality

Every day a property sits vacant represents lost revenue, creating pressure to approve the first applicant. However, experienced investors know patience pays dividends. Rushing tenant placement often means missing red flags—such as unstable income or a pattern of disputes—that later surface as missed rent, lease violations, or costly turnover.

We prioritize placing the right tenant over the first tenant. A short vacancy is a manageable, one-time expense. In contrast, a poor tenant decision can result in months of unpaid rent, legal costs, and repairs that far exceed the cost of waiting for a qualified applicant. Our marketing approach is designed to generate strong demand quickly, allowing us to remain selective without unnecessarily extending vacancy.

Reducing turnover, evictions, and maintenance issues

Tenant screening is the best predictor of future behavior. An applicant with a strong rental history and solid credit is statistically more likely to pay rent on time, communicate effectively, and renew their lease. High retention rates are the holy grail of profitability, as they eliminate the costs of marketing, cleaning, and re-leasing that eat into annual returns.

Furthermore, financial responsibility often correlates with how a resident treats a home. Tenants who respect their financial obligations typically respect the physical property as well, resulting in significantly less wear and tear. By filtering for these traits upfront, we drastically reduce the likelihood of emergency maintenance calls caused by negligence and avoid the catastrophic costs associated with evictions.

How proper screening controls long-term management costs

The cost of management goes beyond the monthly percentage fee; it includes the hidden costs of dealing with problems. A problematic tenant consumes disproportionate resources—requiring constant follow-up for late payments, frequent inspections, and conflict resolution. This operational friction increases your overhead and stress.

By front-loading the effort during the screening phase, we streamline the entire management lifecycle. A high-quality tenant requires less hands-on intervention, allowing for a smoother, more passive ownership experience. This efficiency is a key component of how we deliver value, ensuring that the cost of professional service is offset by the savings in prevented disasters. Understanding this dynamic is essential when evaluating Grandview property management fees, as the cheapest management option often proves to be the most expensive if it lacks rigorous screening standards.

Conclusion: Tenant Placement That Protects Your Grandview Investment

In the world of real estate investment, the quality of your tenant is the quality of your asset. A beautiful property occupied by a non-paying resident is a liability, while a modest home with a responsible, long-term tenant is a wealth-building machine. By prioritizing rigorous, data-driven screening, you shift the odds in your favor, transforming property ownership from a gamble into a calculated, predictable business.

Why disciplined screening leads to predictable cash flow

Predictability is the ultimate goal for any investor. You need to know that rent will arrive on the first of the month, every month. Disciplined screening removes the variables that cause income disruption. By strictly verifying income ratios and rental history, we filter out the financial fragility that leads to late payments. This consistency allows you to plan for future capital improvements, pay down mortgages, or expand your portfolio with confidence, knowing that your existing revenue stream is secure.

When professional tenant placement delivers the most value

While every owner benefits from better tenants, professional placement is particularly critical for investors who cannot be on-site. If you live out of state or simply have a busy career, you cannot afford to drive by the property to collect rent or check on its condition. A professional placement service acts as your eyes and ears, ensuring that the person moving into your Grandview property has been vetted by local experts who know how to spot the difference between a good application on paper and a great tenant in reality. It is also the best remedy for owners who have been "burned" before; if you have ever dealt with a costly eviction, you know that the price of professional screening is a fraction of the cost of a bad experience.

How strong screening supports full-service property management

Tenant placement is not a standalone event; it is the first step in a successful management relationship. A well-screened tenant makes every subsequent aspect of property management easier. They report maintenance issues before they become disasters, they respect the terms of the lease, and they communicate professionally. This synergy allows our full-service team to focus on proactive asset preservation rather than constant crisis management. Ultimately, superior screening is the foundation that allows us to deliver on our promise: protecting your time, your peace of mind, and your bottom line.

Secure Your Grandview Investment Today

Don't leave your most valuable asset to chance. Ensure your property is occupied by qualified, responsible tenants who will protect your investment for years to come.

Contact Raven Property Management KC today for a free rental analysis and let our expert team handle your tenant placement needs.

Ready to work with Raven Property Management?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at 816-281-9357

Agency Contact Form

More Marketing Tips, Tricks & Tools